Unbundling Cash & Equity

a heretical take on "total compensation"

Reader beware: this is a high-concept essay :)

If you've worked in tech, or at any big company, you've probably heard the phrase "total compensation.”

Total compensation, or TC, has many parts, with cash and equity the most discussed. Full-time jobs that offer cash-plus-equity are celebrated and positively symbolic of Silicon Valley ethos. Salary is reliable and risk-free. Stock is risky yet offers upside.

But seeking both from a single opportunity has real tradeoffs. Instead, what if you unbundled cash and equity? Seek both, but from different opportunities.

This is a new philosophy of total compensation, and of work — one that I believe many more ambitious, entrepreneurial people will adopt in the coming years.

The cash-equity tradeoff

Cash-plus-equity offers have an inherent tradeoff.

Employers may present it as a sliding scale — take more cash, get less equity, and vice versa. Employees choose a relative mix based on cash needs, risk appetite, and belief in the company.

People tend to compare compensation offers of a similar type, but rarely across types. What do I mean? I broadly see 3 major compensation types: cash-only, equity-only, and cash-plus-equity. I’ve held all three job types, and I’ve engaged with many peers who’ve held two or more of them in their career.

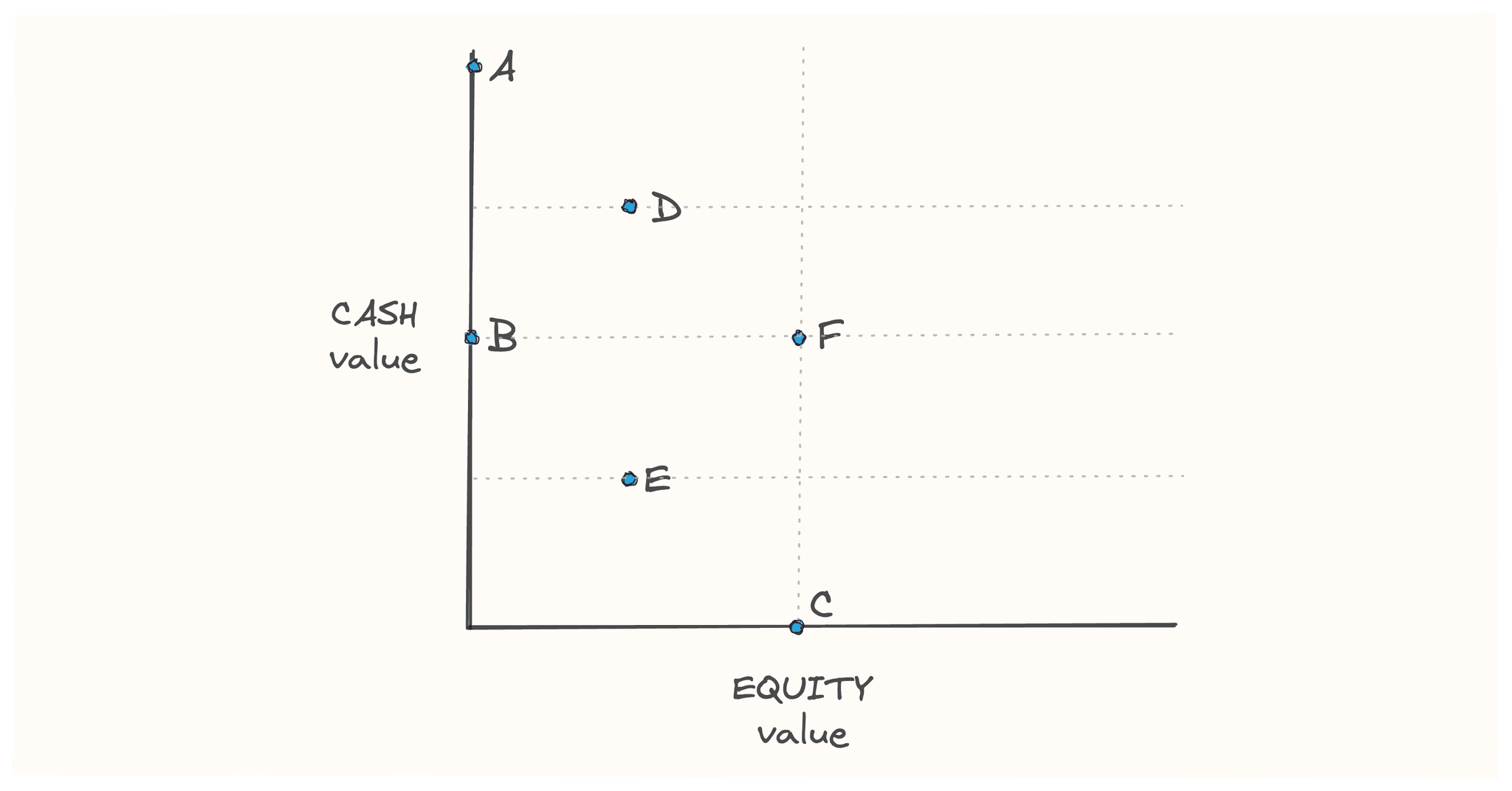

Consider 6 illustrative jobs and their cash-equity mix:

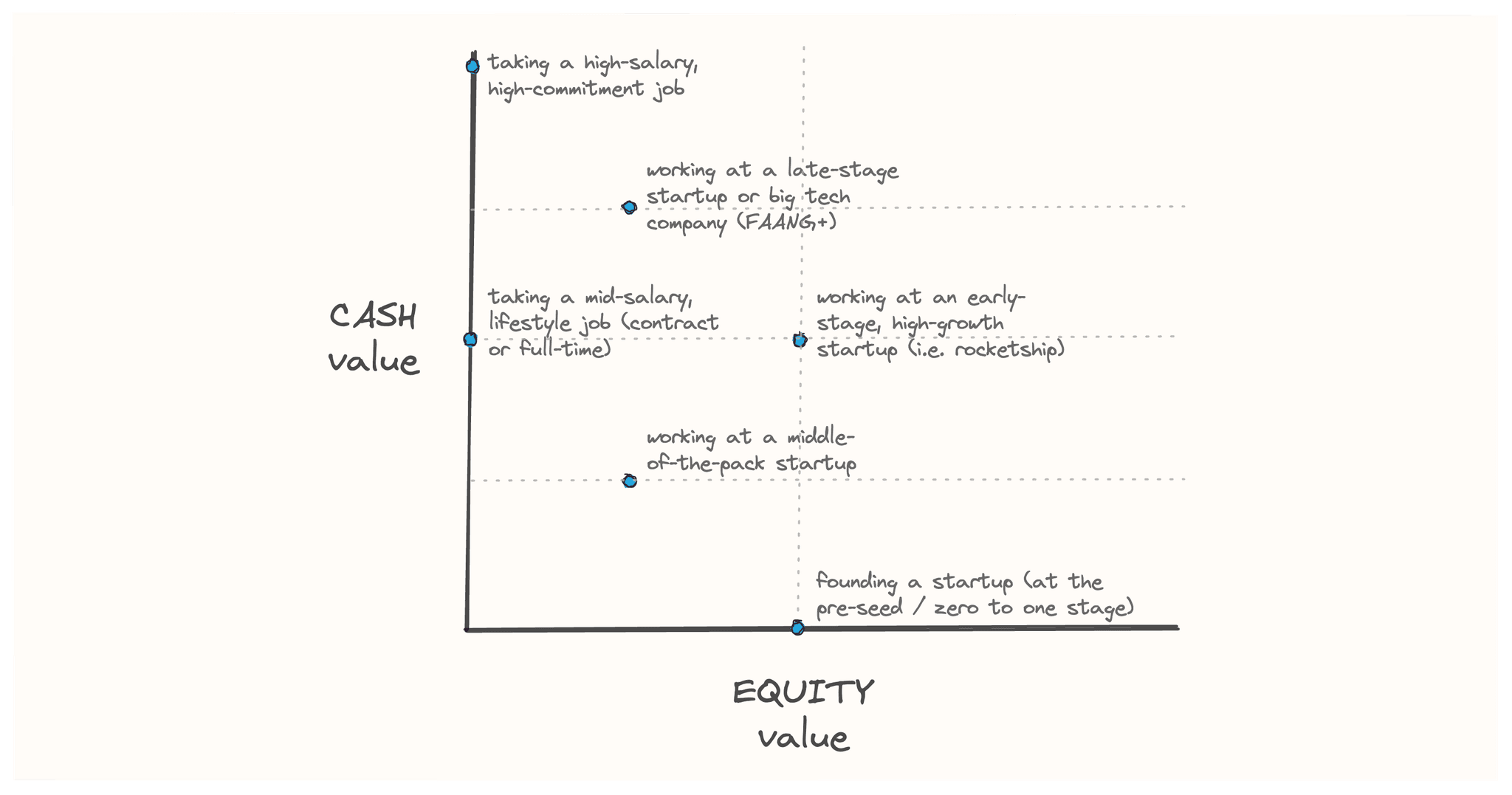

Here's the same chart with descriptive examples: [1]

Now let's break this down into cash-only, equity-only, and cash-plus-equity opportunities.

A and B are cash-only. These could be "9 to 5," part-time, and/or or contract roles at a high hourly rate. In non-traditional tech or fields like banking and medicine, even the most sought-after full-time jobs are cash-only – high base salary, or a moderate base salary plus a large bonus.

C is equity-only. The best example is starting something new, e.g. building a brand, founding a startup. To start, you get zero cash, but you own all the equity. It's hard to peg the value early on, but if you could raise VC for example, you'd get a non-zero valuation. [2]

D, E, and F are cash-plus-equity.

A company like Google pays well, its stock has reliable value, and it’s liquid (i.e. can be sold on public market). [3]

Startups that haven't “broken out” yet tend to offer lower than market salary and have low expected equity value.

"Rocketship" startups offer lower than market salaries, but still on the higher end of all startups since they attract lots of funding. Equity promises large upside.

On additional note — the cash-equity tradeoff is actually a cash-equity-effort tradeoff. At startups, you don't just take a lower salary for equity, you put in disproportionately more effort, e.g. 80+ intensely productive hours per week.

The cash-plus-equity (pipe)dream

The allure of cash-plus-equity is that equity can be worth a lot. The dream is that equity value grows exponentially as the company matures, but the reality that "most startups fail" means that most equity goes to zero.

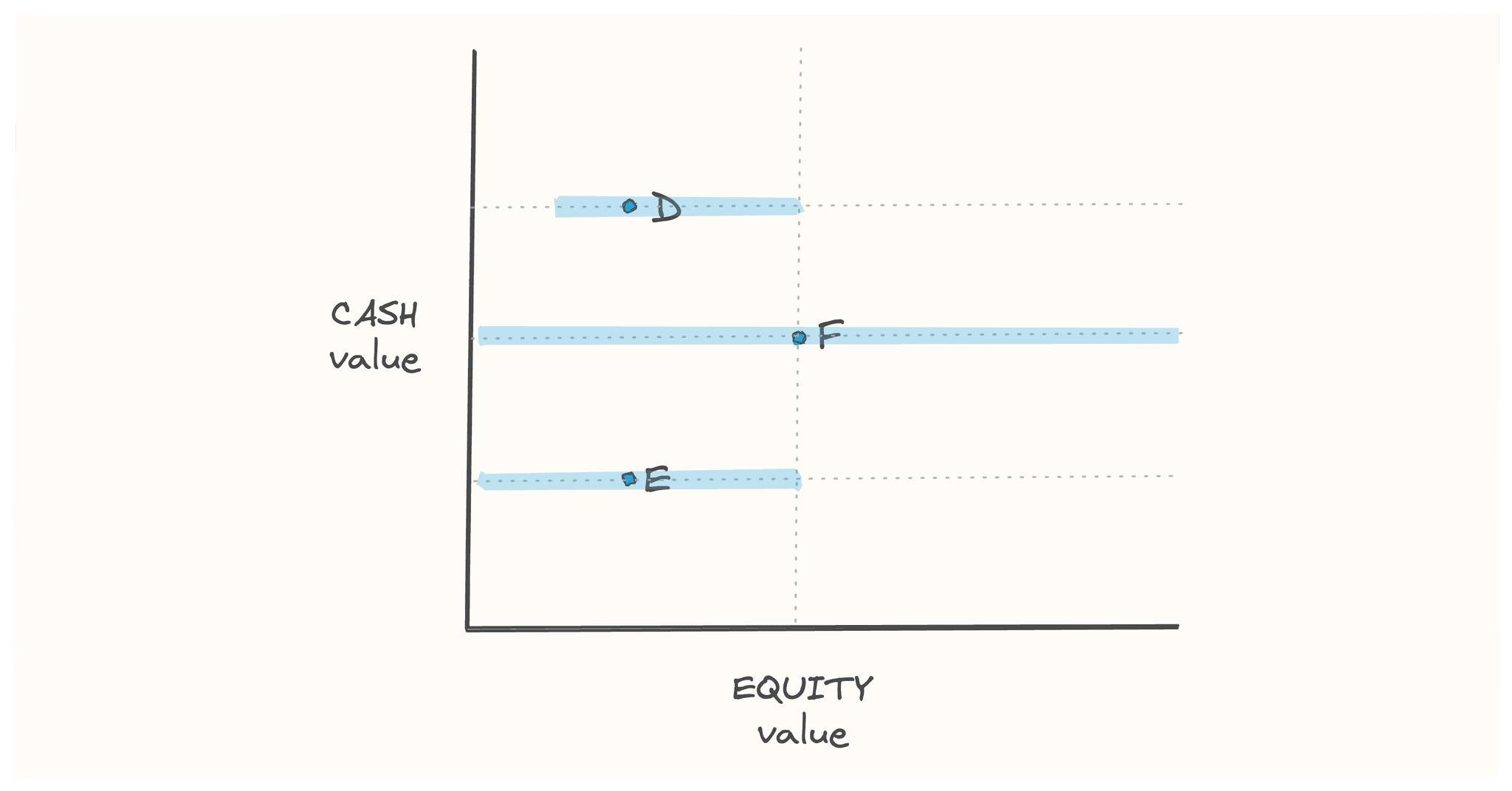

Consider the equity value range for each cash-plus-equity role:

“Big tech” equity (point D) has some upside and relatively little downside; it’s less likely to go to zero (and can be sold too).

“Middle-of-the-pack” startup equity (point E) has all the downside and not much visible upside yet. Early-stage startups have existential risk and stock isn't liquid until exit.

“Rocketship startup” equity (point F) has a theoretical greater upside (e.g. it could 100x) but it can still go to zero. Employees get little equity (less than a percent) and it's often overvalued.

So what? Well, if you take a cash-plus-equity offer, there's a good chance you're giving up cash for nothing. This is why some experienced operators will warn you that equity is just a lottery ticket. They’d tell you the cash-equity tradeoff isn’t worth it.

How to unbundle cash and equity

To allure of unbundling cash and equity is the opportunity to:

maximize cash value and equity value over a "job" portfolio

avoid "concentration risk" in outcomes, skills, and identity

have greater control and flexibility in how you work and earn

So how do you split cash and equity? In short, seek both, but from different opportunities:

Option 1: unbundle them in time — focus on earning cash today and defer equity opportunities until the future. This can be smart if you have high-salary opportunities today (or high cash needs too). A variant is to maximize cash & minimize equity any time you face a cash-equity tradeoff. I don't focus much on this here, but I think it's a very undervalued option.

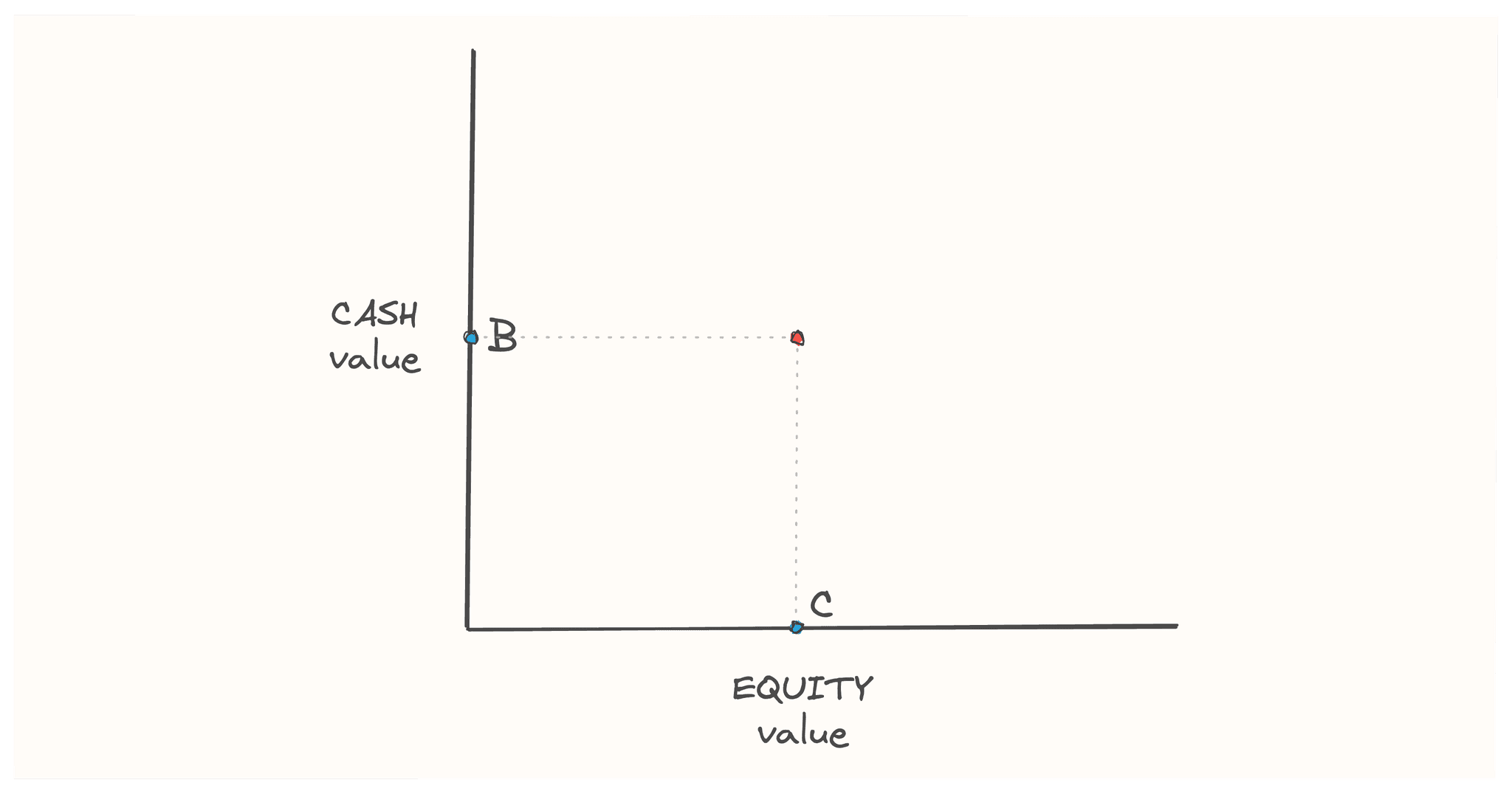

Option 2: unbundle them by source — pursue multiple distinct opportunities at the same time, each offering either only cash or only equity. Highly entrepreneurial, autonomy-seeking people are good fits for this option. [4] This option could look like doing B and C at the same time:

What's immediately intriguing here is the effective sum total of these jobs — they could give you a mix of cash and equity similar to a cash-plus-equity offer from a high-growth startup:

B can be a medium-salary, medium effort job. It could be a full-time "9 to 5" or a part-time, flexibly structured role (e.g. 20 hours a week). Functional specialists could hold multiple contract gigs comfortably. Common wisdom says these types of roles enable entrepreneurial exploration at the same time.

C can be a side-project turned nascent startup. Build solo or with 1-2 trusted people. Bootstrap instead of raising outside capital — you keep the equity. (Consider an SVSB, for example). If you start to get traction and even generate cash flow, you have the option to create your own cash-plus-equity opportunity and go all-in. (Yes, this implies that cash-plus-equity is more compelling for founders than for employees). Another example of a equity-only "job" is angel investing (costs $) or advising (costs time).

Reimagining "total compensation"

Everyone agrees on cash compensation. Whether every employee should also get equity is a philosophical debate. [5] While I think the desire to give everyone equity is virtuous, I'm not as convinced it's in everyone's best interest to take it:

Equity is an agent of FOMO. Everyone wants to reap the potentially exponential rewards of their hard work. So when equity's available, people usually feel compelled to take it.

Cash is king. You've heard the expression. Cash is real and risk-free. Other investment tools (stocks, bonds, etc.) are not.

The cash-equity tradeoff isn’t equal for everyone. If you're already financially secure and/or can command very high cash compensation, you can more comfortably trade cash for equity.

The market bull run also heightened equity worship, but the downturn makes us realists. As we reimagine how to build and fund startups in this new normal, we may need to rethink how employees are and want to be compensated too. Perhaps one ideal is (1) for every employee to get a lot more equity and (2) for that equity to be liquid. These are interesting yet wishful ideas.

In the meantime, I see a compelling alternative: Focus less on equity as employee compensation, and take cash-plus-equity offers off the pedestal. Focus more on unbundling cash and equity, maximizing both independent of each other. "Total compensation" as we know it could use the refresh.

If this working theory resonates, please consider sharing it with a friend (or on socials) & subscribe to my newsletter below. 🙏

Thank you to Aparna Atluru and Bharat Kilaru for all the discussion and feedback on this topic.

Footnotes

[1] It's harder to compare the equity value at different types / stages or startups than it is to compare salaries, so consider the relative positioning on this chart as conceptual.

[2] It's hard to precisely compare the value of equity if you start something versus join a company. If you're a founder, you own a lot more equity, but that equity is worth nothing on day 1. If you join a startup that's doing well, you own very little equity, but it's already worth something on paper. I personally think people undervalue their own ability to create value.

[3] Take a total compensation of $250K at a big tech company. It might break down to $150K in salary + bonus and $100K in stock. This isn't viewed that differently than $250K all-cash given the liquidity and expected stability of stock.

[4] Unbundling cash and equity is the least compelling if 1) you really value the intangible benefits of the traditional cash-plus-equity, full-time role (e.g. network, mentorship, the experience) 2) doing two or more of anything at once is too daunting 2) you're not a self-starter and prefer external structure.

[5] Employee equity is a hot topic in high ceiling industries, e.g. entertainment, sports. In TV/ film, most employees are just salaried, but some writers, actors, directors earn royalties. (There’s still lots of negative sentiment about how much.) In sports, athletes don't get equity in the team franchise. Instead, they negotiate large salary packages and get upside from sponsors and/or creating their own brands.